Whatever the reasons (Discounters or above average price rises) behind current Private Label growth, the fact is that shoppers are getting a wider experience of these products.

Brands must continue to invest to counter the threat but driving this agenda has pitfalls for retailers.

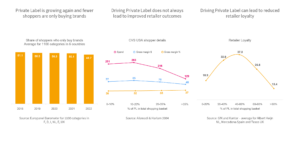

Private Label is growing again and fewer shoppers are only buying brands

Although the pandemic slowed the trend towards Private Label, it has now accelerated again often due to Discounter growth. This means that the share of shoppers who only buy brands by category has dropped sharply and the experience of PL is widening – a major issue for all brands.

Driving Private Label does not always lead to improved retailer outcomes

Using internal retailer data, Ailawadi and Harlam found that although heavier Private Label shoppers provide a higher % margin, they are less valuable in terms of overall spend and cash margin. Not the outcome that might be expected.

Driving Private Label can lead to reduced retailer loyalty

As shoppers increase their buying of PL, retailer loyalty improves to a point but then drops rapidly. These heavy PL buyers ‘shop around’ for the best deals and are not tied to a specific retailer. So there is a ‘sweet spot’ for PL share and this is often below the average PL share in that retailer.