Rising Stars: How and where small brands break through

Coccolino, Fever-Tree, or La Campagnola have a common denominator: They are small brands able to increase their penetration substantially over a short period of time. We call them rising stars. To qualify a brand needed to have between 0.5% and 5% of category buyers in 2013 and to grow this number by at least 50% and at least 1 penetration point over the next three years.

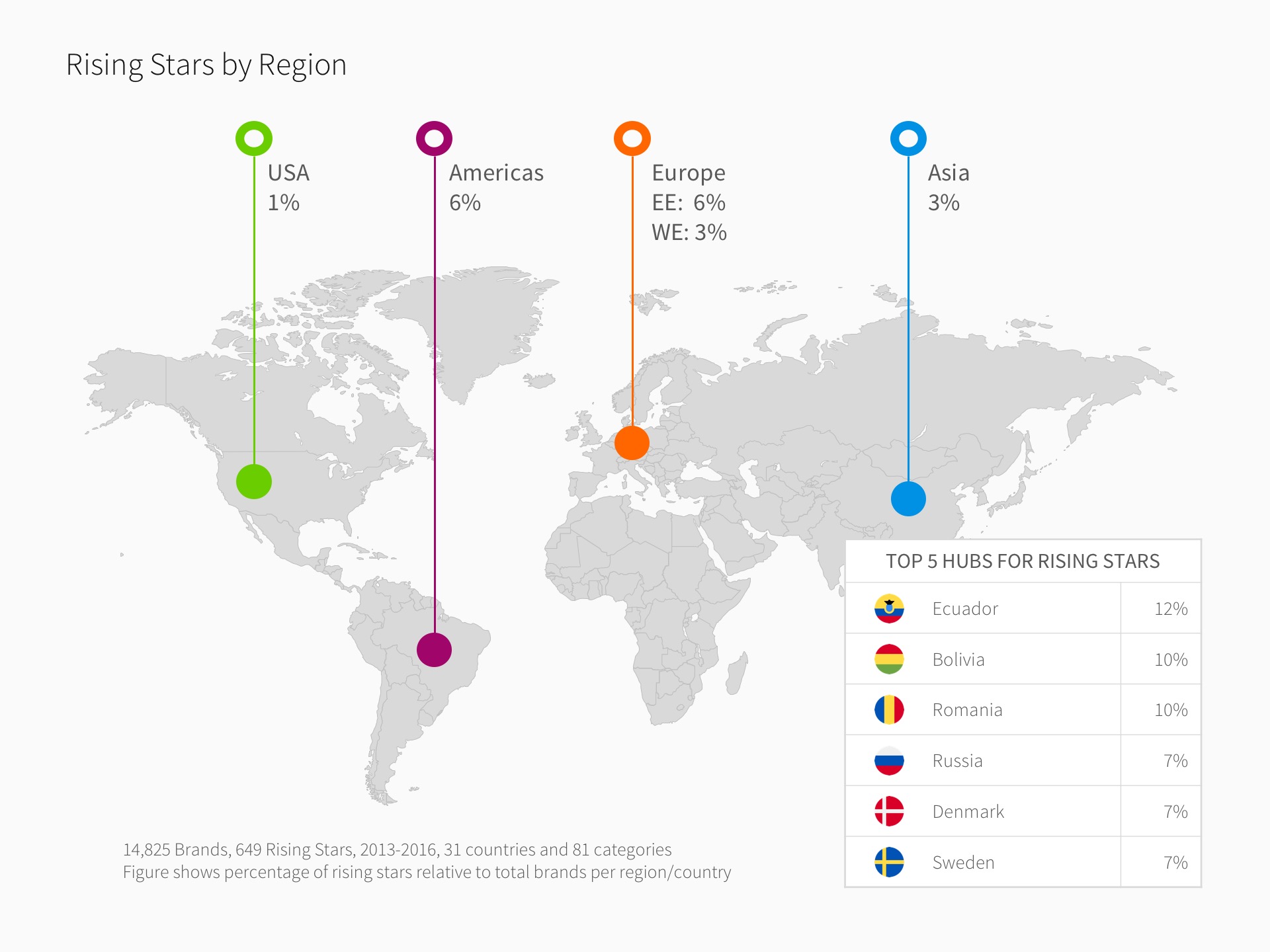

In total 4.4% of all brands in our dataset* of top ten category brands are rising stars. Such brands are more common in Eastern Europe and Latin America whereas they are a rarity in the US (see figure).

In total 4.4% of all brands in our dataset* of top ten category brands are rising stars. Such brands are more common in Eastern Europe and Latin America whereas they are a rarity in the US (see figure).- Especially Ecuador (12%), Bolivia and Romania (10% each) have many upcoming brands, followed by Russia, Sweden and Denmark (7% each). The Netherlands, Germany and the US seem to be comparatively tough spots for rising stars – only 1% of all brands qualify.

- Many rising stars are owned by big manufacturers expanding into new regions and/or categories with Nestlé, Procter & Gamble, and Unilever as the top three manufacturers.

There are hot spots for rising stars – Eastern Europe, Latin America and parts of Scandinavia. But why is the number of upcoming brands smaller in the US and Western Europe? Do fewer small brands meet shopper needs in these markets? Are incumbent brands doing a better job defending their shares? Or are PLs more suited to meet evolving needs?

* Our analysis is based on 14,825 brands across 31 countries and 81 categories.