Retailer presence versus penetration

In our last newsletter, we covered how listings at the top 10 retailers impact market share and penetration. This time, we look at category-specific nuances. Again, we investigate the physical presence of 13,671 national brands at the top 10 retailers in 22 countries. On average, these retailers account for slightly above 70% of the value sales of these brands.

Impact on Penetration

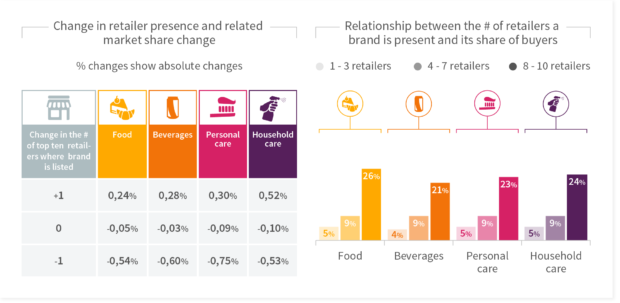

Brands that are listed in 1 to 3 out of the top ten retailers have about half the reach of brands listed in 4 to 7 retailers, a difference which is very similar irrespective of whether the brand competes in food, beverages, household or personal care. Getting into 8 or more of the top ten retailers more than doubles this reach compared to 4 to 7 retailers, with the most pronounced difference in food where the average relative penetration for such brands is 26%. Put differently: Even brands which make it into all or most of the top ten retailers have a lot of headroom: 3 out of 4 category buyers do not choose these brands in a typical year (see figure).

Changes over Time

Taking a dynamic perspective regarding retailer presence (2019 vs. 2016), we find that category matters. Getting listed by one additional retailer translates into a higher market share gain in household (+0.52%) compared to food (+0.24%), whereas personal care categories are most sensitive to delistings (-0.75%).

The strong relationship between marketplace success and distribution is evident. Being listed in more retailers relates to improved reach, getting delisted has the opposite effect. The incremental benefit does vary by category type, but will also depend on the current share of the brand, who its buyers are and which retailer is affected. If you want to learn more about the relationship between distribution and success, please get in touch.

Countries included: Austria, Brazil, China, Czech Republic, Germany, Hungary, India, Indonesia, Ireland, Italy, Netherlands, Portugal, Romania, Russia, Slovakia, Spain, Taiwan, Thailand, UK, US, Vietnam

BG20 Data 2016 and 2019