Brand prices are up

In one of our last blogs we reported that NB price changes have outpaced PL price changes in recent years: especially for beverages and food, and for categories with a high PL share the average price gap between NB and PL has widened. Today we take a closer look to analyse price changes between 2015 and 2019 for national brands:

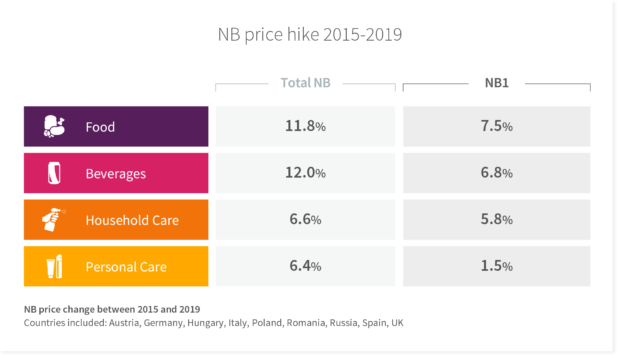

- On average, NBs experienced a price increase of 10% over these

5 years. Brand leaders (NB1s) have increased prices substantially less – by only 5%. In all countries we see that price increases of leading brands lag behind price increases of all brands.

5 years. Brand leaders (NB1s) have increased prices substantially less – by only 5%. In all countries we see that price increases of leading brands lag behind price increases of all brands. - Italy is the only country in which the price level of national brands declined over the past 5 years. Also brand leaders reduced prices.

- Within food and beverages, NBs increased their prices most, by around 12% with leading NBs increasing their prices only by half as much.

- NBs in household care and personal care experienced a smaller price increase of around 6% with leading brands in personal care with almost stable prices (price drops once inflation is accounted for).

#1 national brands obviously did not scale-up their prices as much as other brands. Three potential reasons come to mind: first, the share of promotional activity in the market may have shifted to leading brands even more. Second, brand leaders may feel they have more to lose from higher prices and strategically decided to maintain price levels. Third, retailers are more likely to see prices of leading brands (apart from their private labels) as important and visible signals for their overall value perception and are more reluctant to increase their prices.

More than 700 categories included from Austria, Germany, Hungary, Italy, Poland, Romania, Russia, Spain, UK, BG20 Data covering 2015-2019.