Retailer Category Shares Vary A Lot

Key to understand where there is more or less room for growth

A common metric to evaluate a retailer’s category performance is fair share: By relating the retailer’s category share to its overall market share the resulting index signals areas of strength and weakness. For example, the fair share of a large retailer (15% market share overall) in category X where it captures 12% of value would be 0.8 – indicating a relative weakness in that particular category.

How much do fair shares really vary – in other words: is category performance of retailers consistent or does it show distinct strengths and weaknesses? Again, like in the previous blog, we focus on the #1, #3 and #5 retailer in the Netherlands. Some selected findings:

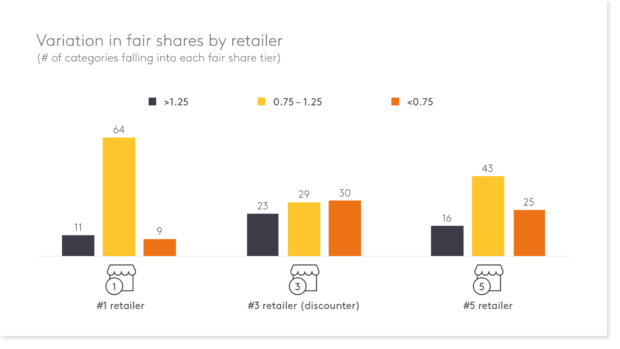

- Fair shares vary dramatically: Each retailer boasts many categories with fair shares exceeding 1.5 or not even reaching 0.3.

- The #1 and #5 retailer show less variation in fair shares compared with #3 which aligns with the strategy of discounters to focus their efforts on selected categories (see figure).

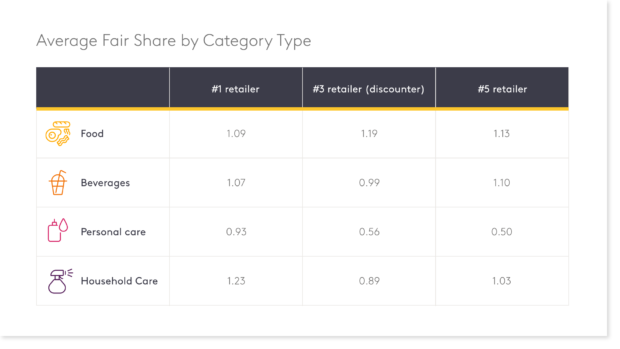

- When aggregating fair shares for specific category types, we see that retailers #3 and #5 show a distinct weakness in personal care while (just) beating retailer #1 in food.

Understanding the fair shares of retailers by category and their sensitivity to different marketing activities (e.g. brand assortment, PL focus, promo intensity, relative price, # of new products) is a valuable source of insights both for retailers who want to grow their category market share and for manufacturers to enable tailored strategic support to retailers. Please get in touch if you have ideas for specific questions to investigate – our database shows retailer category performance for dozens of categories in many countries and five+ years of back data.

Understanding the fair shares of retailers by category and their sensitivity to different marketing activities (e.g. brand assortment, PL focus, promo intensity, relative price, # of new products) is a valuable source of insights both for retailers who want to grow their category market share and for manufacturers to enable tailored strategic support to retailers. Please get in touch if you have ideas for specific questions to investigate – our database shows retailer category performance for dozens of categories in many countries and five+ years of back data.

If you have any comments please contact oliver.koll@europanel.com