How big are the biggest brands? (Part 1)

Today we examine differences across regions and category types.

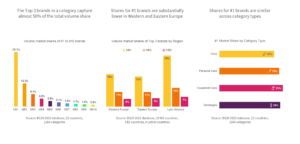

The Top 3 brands in a category capture almost 50% of the total volume share

The average #1 brand across 22 countries and almost 1600 categories sells 29% of the volume sold in the category. This is more than the next 5 brands in the average category together: It does pay off to be the biggest kid on the block. In the average category, 8 brands can expect to sell more than 1% of category volume sales.

Shares for #1 brands are substantially lower in Western and Eastern Europe

#1 brands in Western and Eastern Europe fare substantially worse: On average they capture only 25% and 23% of the market respectively, a level that is much lower than what the #1 brand in Latin America can expect (39%). Clearly PL is the major factor driving these differences. Next week we will take a closer look how PL affects the shares of differently sized brands in different regions.

Shares for #1 brands are similar across category types

Category types show similar shares for their respective #1 brands. While food brand leaders capture somewhat smaller shares than their beverage, personal and household care peers (about 3% less), they perform well in light of the much higher PL shares they have to deal with (about 10% higher). Food and Beverage #1 brands also maintain slightly higher leads (2.5 times larger) versus their closest competitors than PC and HH leaders (2.2 times larger).