Portfolio sizes differ by market

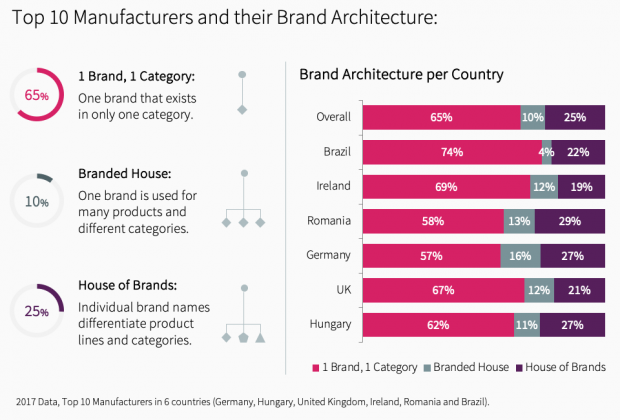

Two out of three manufacturers are single brand single category players. What about the brand portfolio size and category scope of manufacturers with a larger portfolio?

- In the 6 countries* analysed we find, on average, 2,412 different manufacturers and 4,015 different brands across our category scope. 75% of all manufacturers have only one brand, but sometimes this brand is present in multiple categories or markets. 1 in 4 manufacturers have at least two brands competing in the same category.

- The German and the Brazilian markets are the most competitive ones: We find, on average, 60 manufacturers per category in Germany and 73 in Brazil, as opposed to 22 in Ireland

- Not surprisingly, manufacturers that have many brands own higher market shares. For example, German manufacturers with more than 10 brands in their portfolio (just 1.2% of all manufacturers) have a combined 16% share of total FMCG (in the BG20 scope), whereas the 74% of manufacturers with just one brand jointly reach 12% share.

In summary most manufacturers follow a single brand single category strategy. Manufacturers with more brands gain a higher value share on average. In our final blog entry we investigate how the type of brand portfolio strategy impacts the level of value and volume share.