What the top dogs get

Winners get a lot of attention, whether it is sports, politics or Dancing with the Stars. While the success of winning in these fields tends to be defined by individual years, many winning brands in FMCG have held their position for decades or longer. This continuity breeds familiarity and trust, whether it is the chocolate spread for breakfast that reminds people of their childhood, the pasta that must be cooked for friends, or the washing powder which grandma has always used. But how big are these winners in times of supposed market fragmentation and continuing PL growth in many markets? We analyzed the 2019 market shares of 1,652 leading brands in 22 markets and across 89 categories and find that…

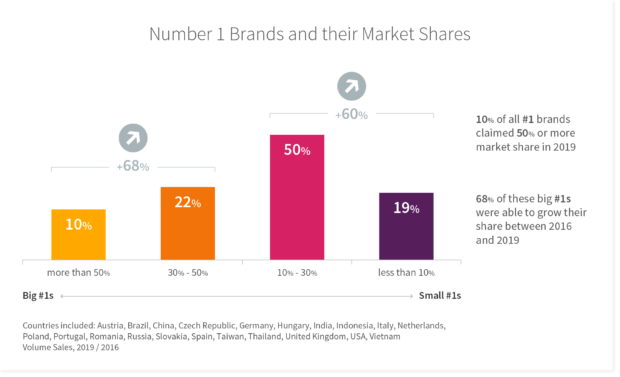

- 10% of all #1 brands claim more than 50% market share, while 20% of the leading brands need to subsist with less than 10%.

- #1 brands do best in household care: 23% of all leading brands are able to command a market share of 30% or higher. In food and beverages, however, only 15% of all leading brands reach these levels.

- Of all #1 brands in 2019, 61% were able to grow their shares between 2016 and 2019. This growth has been most pronounced among big #1 brands – 68% of them were able to boost their share. But even among the small #1s 60% were able to grow share.

As above, the ‘splendor’ of number 1 brands varies from more than half of all category sales to less than 10%. Even amongst the winners, some have been more successful in figuring out how to appeal to a large portion of buyers (and retailers) irrespective of the variety in consumer needs, shopping occasions, or willingness-to-pay.

Countries included: Austria, Brazil, China, Czech Republic, Germany, Hungary, India, Indonesia, Italy, Netherlands, Poland, Portugal, Romania, Russia, Slovakia, Spain, Taiwan, Thailand, United Kingdom, USA, Vietnam

Volume Sales 2019 vs. 2016