Pack sizes: When offerings and preferences diverge

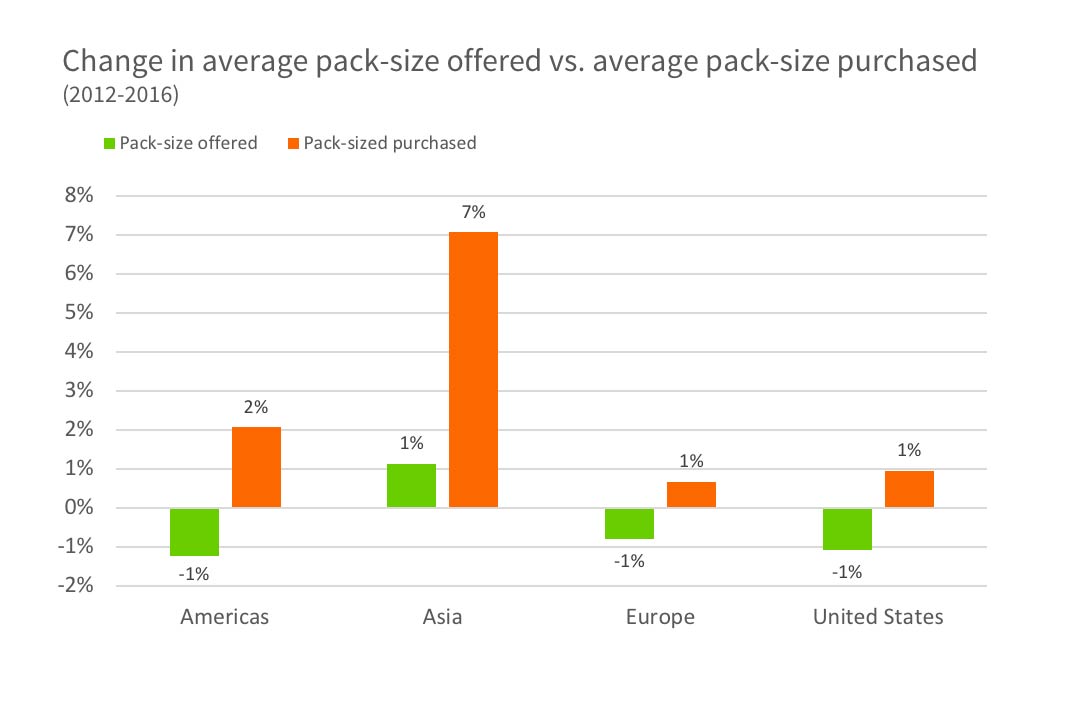

Besides the oft-cited examples of manufacturers reducing established pack sizes to hide price increases, several socio-economic and behavioural trends (e.g.: more single households, health consciousness, variety seeking) have motivated manufacturers to add smaller packs to their repertoires. This move risks creating the impression of a bad deal: little value for a lot of money. We analysed how pack sizes offered by manufacturers and pack sizes actually purchased by consumers changed between 2012 and 2016 on a global scale*.

Brands have decreased their average pack size offered, except in Asia (+1%) where we find a small increase and for personal care, where the average pack size remained unchanged.

Brands have decreased their average pack size offered, except in Asia (+1%) where we find a small increase and for personal care, where the average pack size remained unchanged.- Manufacturers reduce the average pack size on offer most in these categories: liquid detergents, kitchen papers, razor blades and spirits.

- Shoppers’ actual behaviour does not reflect this trend: they tend to purchase larger packs, especially in personal care (+2%) and household care (+3%) as well as Asia (+7%).

- Categories where consumers choose bigger packs include beer, heavy-duty washing powder, liquid detergents, toothbrushes or mayonnaise.

These results confirm our previous insights from 3 countries (Austria, Spain, France) on a global scale: brands increasingly launch smaller pack sizes but shoppers do not follow. Offering smaller packs may help the bottom-line given the usually higher price per unit/gram/ml. However, trends like lower shopping frequency, higher car ownership and a desire to economize seem to make large packs more appealing.

*Analysis includes 25 countries, 86 categories and 13,991 products.