A closer look at new products

category variations in brands’ contribution to new product activity, launch price premia relative to their parent brand and the distribution they can expect to gain

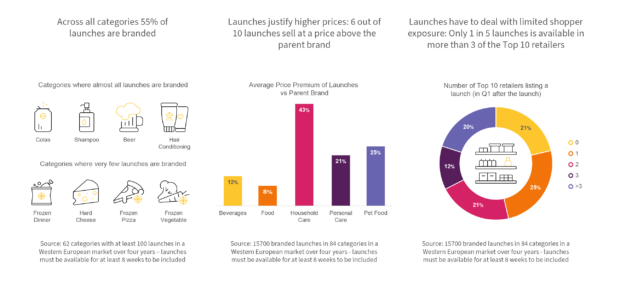

Across all categories 55% of launches are branded

This number varies massively – while in some categories 9 out of 10 launches are national brands, Private Labels dominate the new product activity in others. Clearly, this is both a consequence and a predictor of Private Label success in a category.

Launches justify higher prices: 6 out of 10 launches sell at a price above the parent brand

Willingness-to-pay results from a perception of high value-for-money. One important avenue to create high perceived value is to deliver new benefits. While not all launches feature high newness, the average price premium versus the parent brand’s existing range is 20% and more than 40% in Household Care.

Launches have to deal with limited shopper exposure: Only 1 in 5 launches is available in more than 3 of the Top 10 retailers

Availability is key to the success of brands and launches alike, but only half of all branded launches manage to get listed by more than one of the Top 10 retailers. Next week we will examine how the power of the parent brand impacts the retailer presence of a launch.