How do discounters grow in times of uncertainty, in ‘normal’ times and in 2022 so far?

How do discounters grow in times of uncertainty, in ‘normal’ times and in 2022 so far? This varies by type of category by country but the rules of growth apply to all.

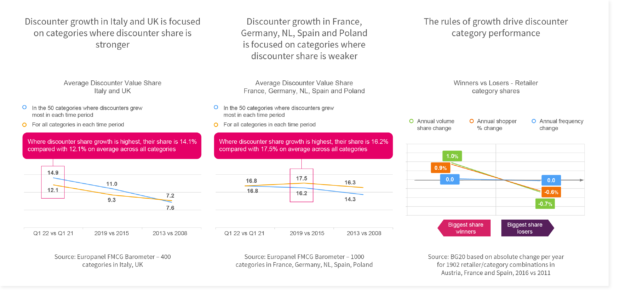

Discounter growth in Italy and UK is focused on categories where discounter share is stronger

In countries where discounter share is smaller and developing, absolute share growth is greatest in categories where their share is already strong – especially food categories. This has been the case once shares really increased in the 2 countries after 2013 and has continued in 2022 so far

Discounter growth in France, Germany, Nl, Spain and Poland is focused on categories where discounter share is weaker

In countries where discounter share is stable or mature, absolute long term share growth is greatest in categories where their share is weak – and includes a wider set of categories not just foods. For 2022, so far, the relationship is ‘average’ but again covers more types of category

The rules of growth drive discounter category performance

Discounter category growth follows the usual pattern– it’s all linked to the number of shoppers per category and not shopping frequency. This is true for all period to period and country comparisons