Volume growth is hard to come by in Western Europe. Over 4 years more than half of all categories experience a decline, with even more categories shrinking over the past year. More (vs 4 years ago)/less (vs last year) work from home shows its impact.

But the financial uncertainty and inflation will also cause more deliberate choices.

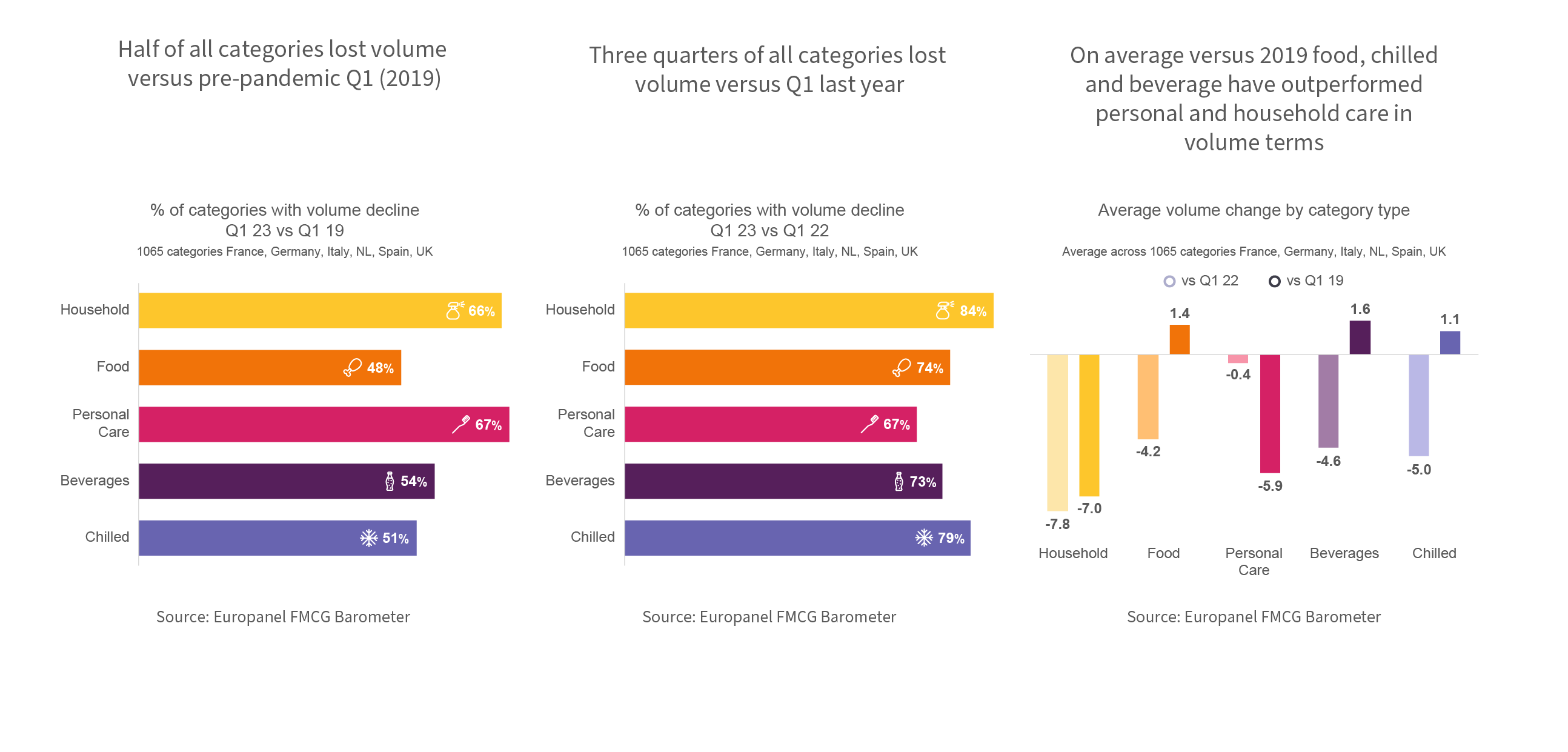

Half of all categories lost volume versus pre-pandemic Q1 (2019)

In comparison to Q1 2019 more than half of all categories have lost in terms of volume in Q1 2023. The super-categories where volume drops are most frequent are household care and personal care with 2 out of 3 categories in decline.

Three quarters of all categories lost volume versus Q1 last year

In comparison to one year ago volume drops are common across all types of categories. Typically less than one third of all categories experiences volume growth – it is key to identify these categories and learn from them what can be done to keep your category from shrinking.

On average versus 2019 food, chilled and beverage have outperformed personal and household care in volume terms

Average volume growth (note: there is a lot of variation within each category type) has been modest in food, beverage and chilled versus 4 years ago. The average personal and household care category has seen a drop of more than 5% (possibly due to formula changes in some categories) with personal care being quite stable since last year.