House of Brands beats Branded House*

The share a brand commands is the consequence of many past actions. The decision about brand portfolios is only one of these actions. Linking share numbers to this single decision therefore will provide an incomplete picture but here, nonetheless, we compare the outcomes of different brand portfolio strategies, but ask you to interpret the results with care!

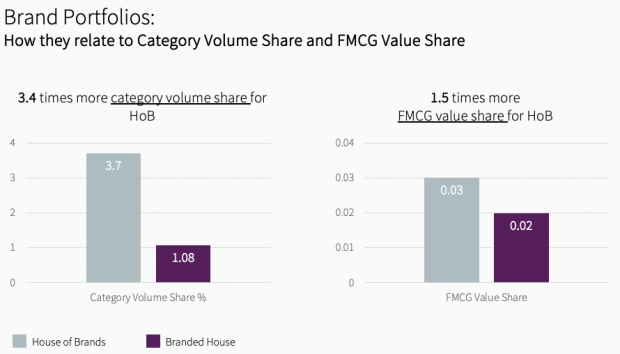

- A House of Brands strategy reaches higher within-category shares: Brands that belong to a House of Brands manufacturer command, on average, 3.7% category volume share, compared to 1.1% volume share for brands that are part of a Branded House.

- This difference becomes much smaller if we take a cross-category perspective. After all, a Branded House aims to leverage the brand’s equity across multiple categories. Using total FMCG as the baseline, the House of Brands strategy still results in higher shares. Brands that are part of such a portfolio, on average, reach 1.5 times the value share of their peers from a Branded House.

Therefore a Branded House strategy with the presence of a brand in multiple categories does not outperform brands that are part of a House of Brands.

Many reasons come to mind: consumers may rely more on brands specialized in certain categories than on all-rounders; there may be a bias of big manufacturers to a House of Brands approach; or it may simply be difficult to be proficient in many categories. As always, averages hide a lot of variation and we invite you to contact us to learn more about brand portfolio strategies and their consequences.

* A Branded House strategy is one brand for all products across categories (e.g. Tchibo, Nivea, Tesco). A House of Brands has individual brand names, with the corporate name often taking a less prominent role (e.g., Unilever, Nestlè).

*Countries included in the analysis: Germany, Hungary, United Kingdom, Ireland, Romania and Brazil