Having looked last week at the potential future growth for Discounters and Private Label, we now look at 2022 as a whole and what has driven share rises.

This is set against a backdrop of volume strength for the FMCG market.

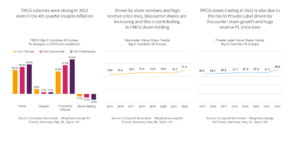

FMCG volumes were strong in 2022 even in the 4th quarter despite inflation

Comparing with the pre-pandemic ‘normal’ 2019, FMCG values in 2022 were considerably ahead due to inflation but critically volumes, even in the last quarter, were also up. Unsurprisingly down-trading to cheaper options increased significantly.

Driven by store numbers and high relative price rises, Discounter shares are increasing and this is contributing to FMCG down-trading

Following share stability during the pandemic, Discounters are now taking advantage of more stores compared with 2019 especially in Italy and UK. The other key driver of value share growth is that Discounter prices are rising 50% more than average.

FMCG down-trading in 2022 is also due to the rise in Private Label driven by Discounter share growth and huge relative PL price rises

PL share was stable over the pandemic. Discounter growth and PL prices rising double the rate of brands are the sole reasons for the return to value share growth. Discounters are key to the growth in Germany, Italy and UK and mainstream retailers in France, NL and Spain.