Underpriced Innovations!?

Pricing a new product is tough: Charge too much and it won’t sell. Charge too little and forgo revenue or undermine brand equity. But at what price levels do brand manufacturers actually sell their innovations? We looked at nearly 6,600 brands in 19 markets and compared new product prices with the average shelf price of the brand launching them.

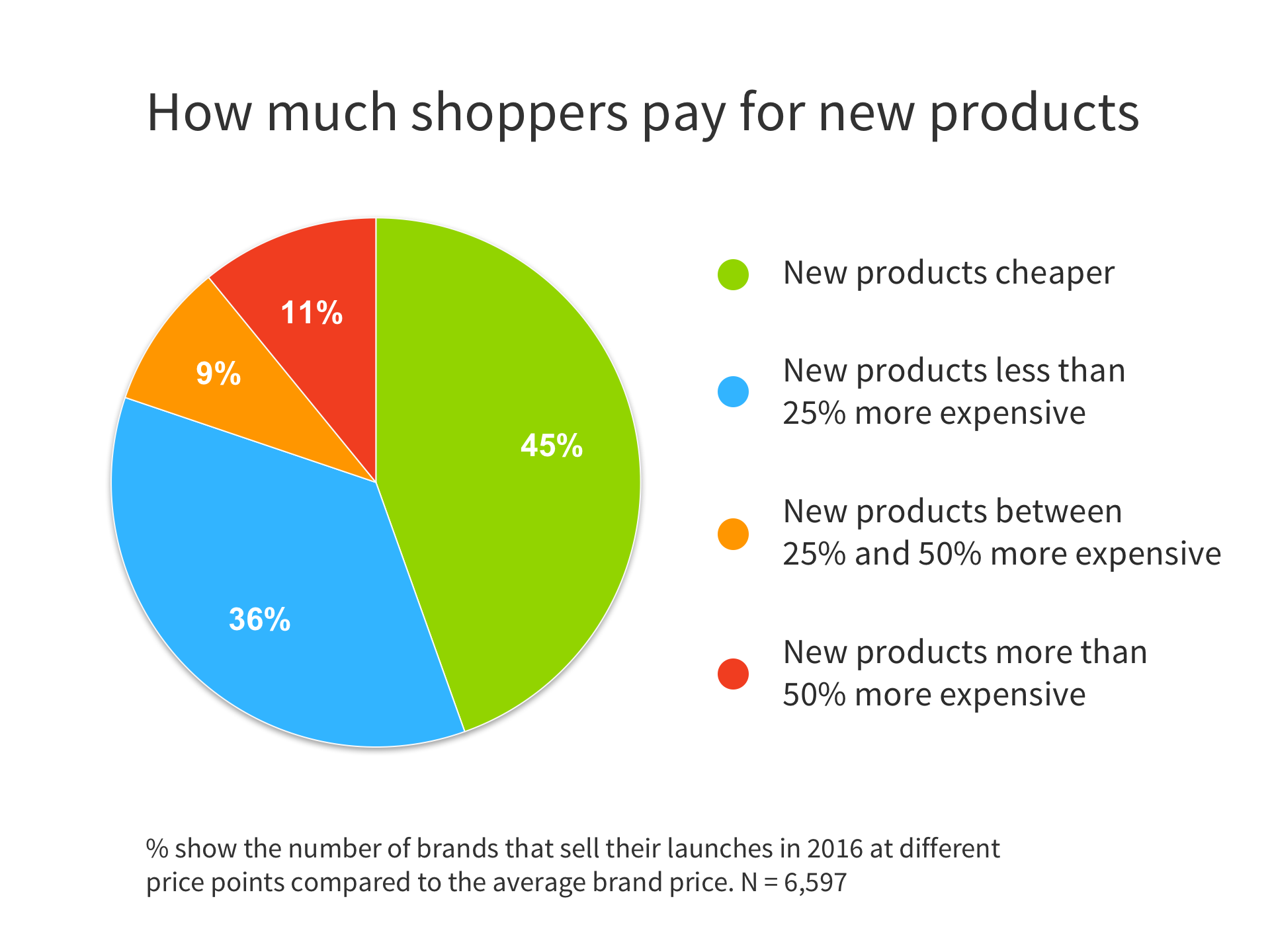

20% of all new launches charge a premium of more than 25% and 11% of all innovations sell at premia of 50% or more.

20% of all new launches charge a premium of more than 25% and 11% of all innovations sell at premia of 50% or more.- However, 45% of all new launches sell below the average price of the brand launching them.

- Price premia in beverages are a bit higher, with nearly a quarter of all brands introducing new products at 25% or more of the brand’s average price. High launch prices are least prominent in household care.

- New products do best price-wise in Italy where 25% of all brands sell innovations at premia of more than 25% followed by UK and France (22%).

Brand manufacturers should think carefully about their innovation and pricing strategy: me-too products with limited benefits (new flavor, packaging, color) vs. new products the market has not seen before. Even so, why are 45% of all new products priced below the average price of the brand launching them? Do introductory promotions undermine value? Are many innovations aiming at the budget segment? How do such prices impact a manufacturer’s overall price position?