Private Label lags behind Online

Private Labels (PL) have become a dominant part of the assortment of many grocery retailers. But is PL equally prominent in online as in offline baskets, given that retailers have even more control over the assortment that shoppers are exposed to.

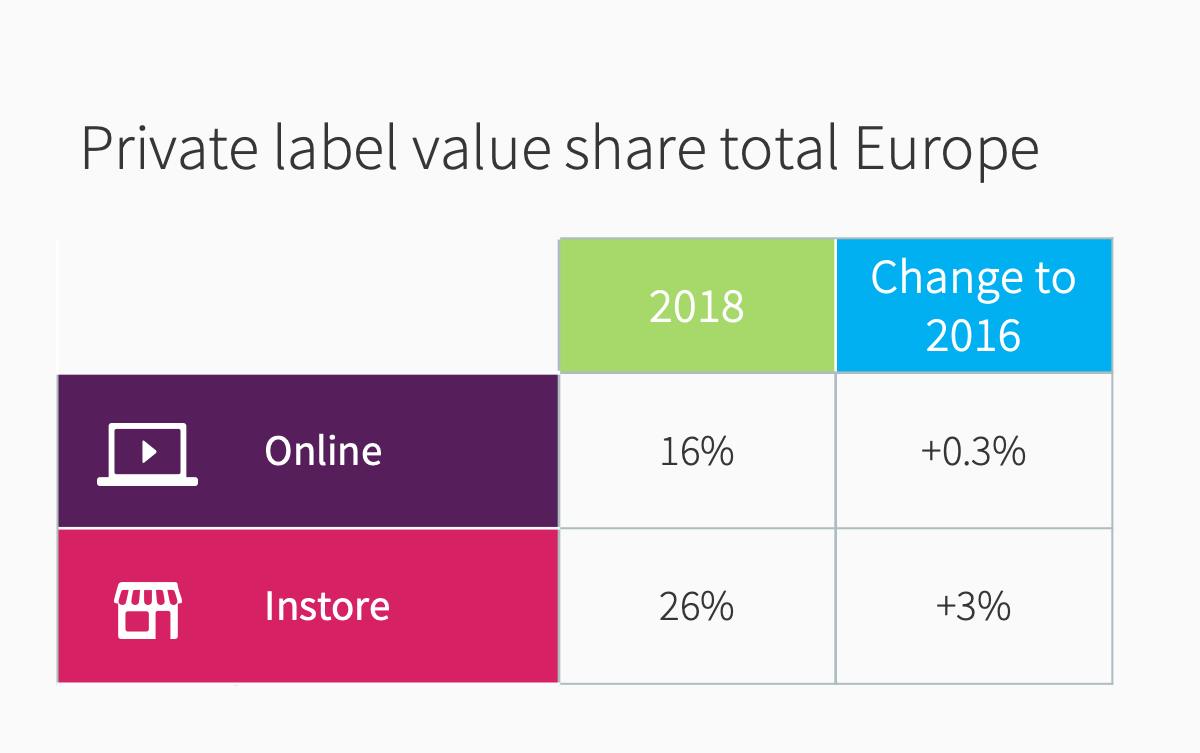

- In 2018, on average across all markets covered*, 26% of shoppers’ total in-store spending goes to PLs – 3% more than 2016. The online value share of PLs is lower (15%) and did not change.

- The UK has the highest PL online value share (48%), followed by France (39%), and the Netherlands (36%) – levels that are largely in line with offline value shares of PL.

- Countries in which PLs gain a comparable low online value share include the Czech Republic (3%), Poland (5%) or Romania (2%).

- Countries in which we see a major increase in the online value share of PL are Austria (+40%), Sweden (+47%) and Germany (+25%).

On average, PL online shares lag substantially behind offline. Several reasons that explain this situation:

- Shelf: PL products receive more attractive shelf positions offline than online (also, each SKU has one facing only online, giving the larger assortments of national brands more relative prominence)

- Motivation: Purchasing online may be driven more by time than financial constraints reducing the importance of price in decision-making

- Retailers: discounters are less likely to have a major online presence

- Category: online may be skewed in favour of product categories with lower PL shares

- Shoppers: online buyers, often younger households with higher incomes, may be less likely to choose PL.

Want to understand online shopping in more detail? Get in touch!

* Austria, Belgium, Croatia, Czech Republic, Denmark, France, Germany, Hungary, Italy, Netherlands, Poland, Romania, Russia, Slovakia, Sweden, UK, Ukraine