The Size of the Price

Selling at a high price point presents opportunities as well as challenges. On the one hand a high-price strategy can pay off as brands get more sales (and possibly profit) from every single transaction. On the other hand, being a high-price brand represents a financial hurdle for shoppers unwilling or unable to afford the product resulting in limited reach. We examined the relationship between the price level of top ten brands (relative tothe category PL price) and market share both on the individual and aggregated level across 2,400 categories in 31 countries.

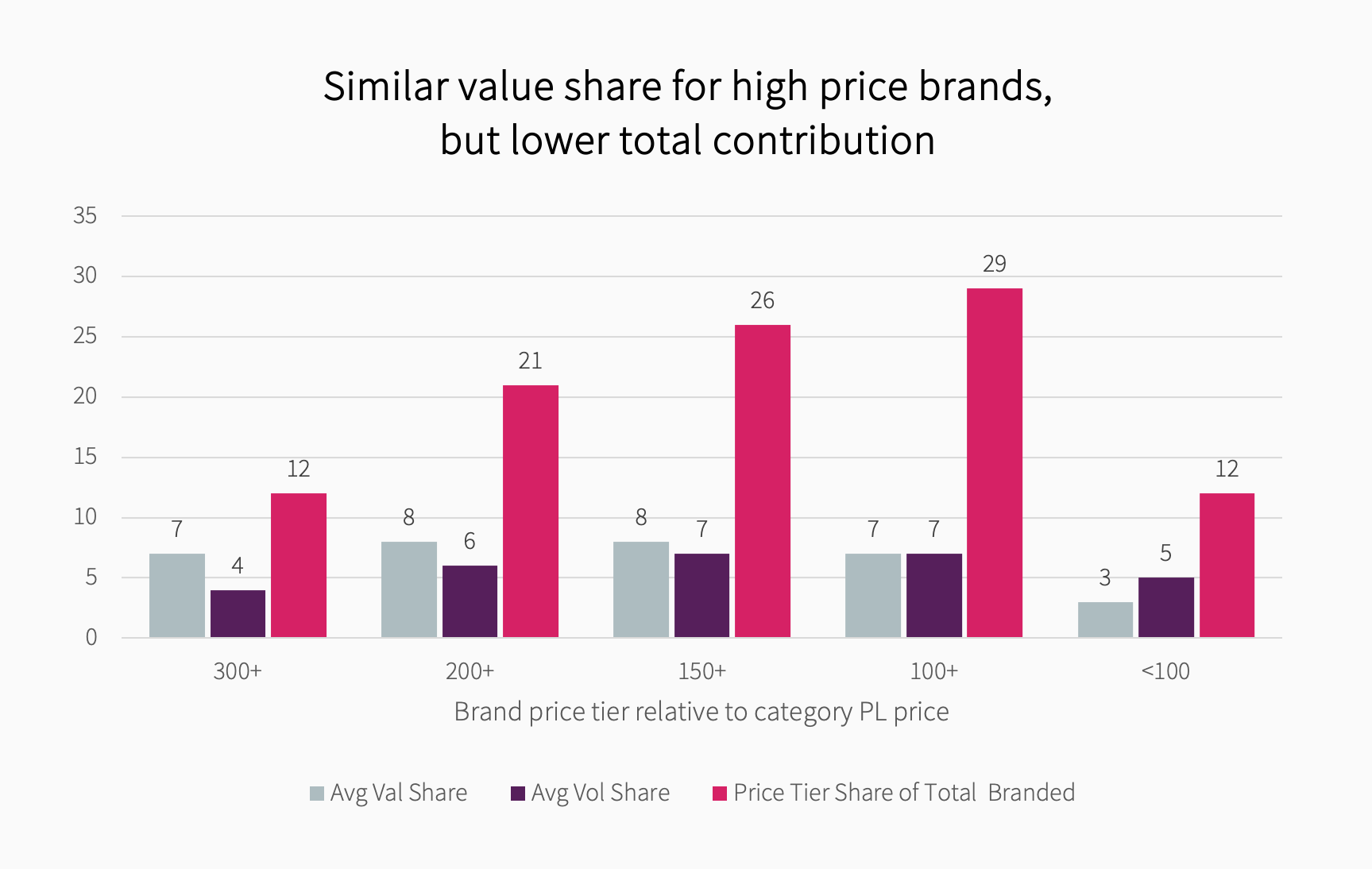

- Expensive brands on average compensate their lower volume shares relative to more moderately priced brands and manage to attain similar value shares. The average top ten brand reaches a comparable value share – irrespective of whether it is 1.5, 2 or 3 times more expensive than PL. The only tier not keeping up are brands priced below PL levels. They are typically quite small.

- But because high-price brands are less common in the Top 10 than low-price brands, their total contribution to national brand sales is lower: On average across all categories, brands with a price of less than two times the price of PL account for two thirds of sales, and brands with a price of more than two times the price of PL for one third of sales.

High prices work and are not hindering success. But the lower number of such brands shows that there is a limit to how many brands can take that road. Please get in touch to learn more about where and in which categories premium brands thrive.