Manufacturer brand portfolios and FMCG market predictions

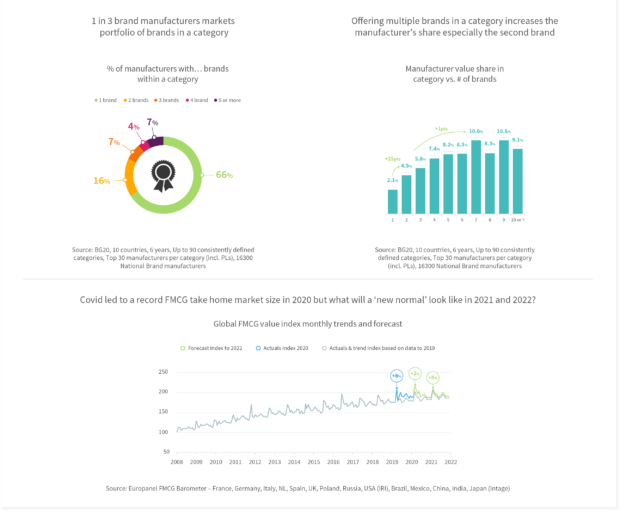

Manufacturer brand portfolios: this week we summarise the number and size of portfolios and then look at how each additional brand develops manufacturer share within a category. Our third topic looks at my predictions for the FMCG market over the next couple of years.

One half of all portfolios boast two brands only. Looking at the 10 biggest players in FMCG – they offer a portfolio in 40 to 70% of the categories in which they compete. Two of them have 5+ brands in more than 20% of the categories in which they compete.

One half of all portfolios boast two brands only. Looking at the 10 biggest players in FMCG – they offer a portfolio in 40 to 70% of the categories in which they compete. Two of them have 5+ brands in more than 20% of the categories in which they compete.- Beyond the second brand, additional brands bring returns but diminishing ones. And category buying frequency matters – the impact of the 2nd brand is similar but more brands pays off most in high frequency categories.

- FMCG globally in 2020 was 8% higher than pre-Covid expectations. Assuming a relaxation of rules, continued extra working from home and no inflation spike, I expect 2021 to be 2% above 2020 and 2022 to be stable. This represents a long term benefit of 2 to 3 % vs what we expected in 2019.