Changes in Brand Price Premia

Changes in the price premium of National Brands versus Private Labels can result from various trends. For example, NBs increasing prices more (or decreasing prices less) than PLs would increase their price premium. In contrast, NBs increasing prices less (or decreasing prices more) than PLs would decrease their price premium.

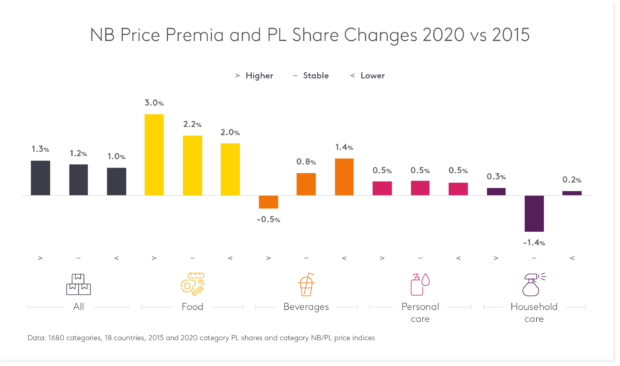

But are consumers even reacting to shifts in the relative price gap between NBs and PLs? We allocate all categories into three groups: (1) categories where the NB price premium versus PL has increased by at least ten percentage points between 2015 and 2020 (e.g. from 215% to more than 225%), (2) categories where the NB price premium versus PL has decreased by at least ten percentage points (e.g. from 215% to less than 205%), and (3) the remainder where the price premium has remained quite stable.

These are the differences we see regarding PL share movements: In categories where NB price premia have gone up, PL share gains have been slightly higher than in categories where NB price premia have gone down (1.29% vs 1.03%). Food is the category type where this relationship is most pronounced. Beverage categories, on the contrary, see the most PL growth where the price premium has declined.

While the previous blog shows that large premia are not detrimental to NB success, monitoring the impact of changes in the price difference of brands versus Private Labels in the category (not just in total, also individual brands) on brand success is essential. This analysis is the ultimate response to a brand’s success in improving its value proposition.

Data: 1680 categories, 18 countries, 2015 and 2020 category PL shares and category NB/PL price indices