A Focus on Russia

Russia: Between recovery and uncertainty

| 2017 has been a year of economic recovery for Russia. After being hit by a 2 year long recession, the Russian economy is back in growth; consistently growing above +2% for GDP year-on-year for the past 6 consecutive quarters. This has led to new foreign investments. |

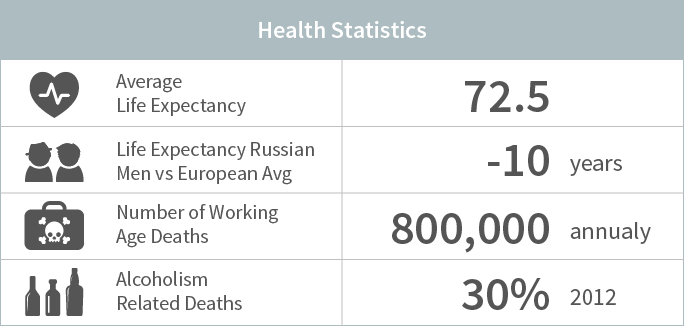

| Improvement in health but plenty of issues remain |

| Within the food categories, the largest increase is observed in Grocery, Sweets and snacks |

| Global players playing the local field |

| Opportunities for the 2018 World Cup |

For further insights, please read download the PDF version here or contact us at understand@europanel.com

Best wishes,

The Europanel Thought Leadership Team