This week we are looking at innovations (quantity, shares and type) across key Western European markets.

How many innovations enter the market, and how truly innovative are they? How much do brands rely on the sales of their innovations?

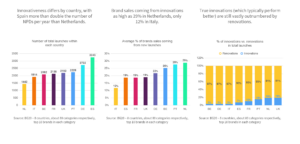

Innovativeness differs by country, with Spain more than double the number of NPDs per year than Netherlands.

There are significant differences in the number of new launches by country. The number of innovations does not directly relate to the quality of those launches, but it does hint at potentially more competitive NPD environments in for example Spain and Germany as compared to Netherlands.

Brand sales coming from innovations as high as 29% in Netherlands, only 12% in Italy.

Brands in Netherlands, Portugal and Belgium rely much heavier on the sales of NPDs, as compared with Italy. Consumers’ willingness to try new products, the quality of the existing range as well as the quality of (launch of) NPDs themselves does come into play here.

True innovations (which typically perform better) are still vastly outnumbered by renovations.

True innovations range from 3% to 19% of total NPDs across EU countries, with UK and NL seemingly great ´testing´ grounds for the more innovative products. Previous research has shown that true innovations are worth more than double than renovations, and result in much higher trial rates.