The Power (and Peril) of High Prices

The prevalence and characteristics of premium brands

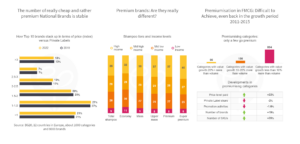

The number of really cheap and rather premium National Brands is stable

Both in 2019 and 2022 the relative number of Top 10 National Brands in different price tiers has remained very stable. 1 in 5 is cheaper than Private Labels, almost half are less than twice as expensive and one third is more than twice the price of Private Label in their category.

Top 10 brands that charge more than twice the price of Private Labels are most common in personal care where more than 4 out of 10 Top 10 brands qualify – compared to only 2 in 10 in food categories.

Premium brands: are they really different?

“Premium brands command higher loyalty and are predominantly bought by affluent consumers” – these are two popular beliefs on brand premiumization, a branding strategy to differentiate via superior value and high price. An analysis of some personal care brands across many countries (beyond the shampoo example in China shown here), however, provides a different picture:

1) Premium brands typically have a limited number of buyers since they often rely on specialist channels like drugstores or online retailers in this case. Therefore they depend more on repertoire buyers and are often bought in combination with brands from other price segments. Very few consumers are exclusively loyal to premium.

2) It is true that affluent shoppers are more important for premium brands, but middle and lower income groups should not be ignored as they represent large parts of premium brands’ customer bases as well. Premium brands, thus, have to maintain a balance between being aspirational but still accessible to many.

Premiumisation in FMCG: difficult to Achieve, even back in the growth period 2011-2015

Premiumisation is a challenging avenue for growth in FMCG given the focus on low prices in the marketing communication of both retailers and manufacturers. We examined 1,116 categories and more than 10,000 brands over the five years 2011-2015 in 15 countries to learn whether and how premiumisation is possible. Our operationalization of premiumisation is that the category grows substantially more in terms of value than in volume.

Overall, our results show that strong premiumisation is rare: out of 1,116 categories only 66 (6%) experience value growth exceeding volume growth by more than 20%. These premiumising categories cover different category types, but bean and ground coffee, chocolate spread, canned fish, tonic water, beer or kitchen papers premiumised in multiple markets.

For these categories we find

- a significant increase in price paid for private labels as well as brands

- a reduction in private label share and less promotion pressure

- an increase in the number of brands and SKUs – premiumising categories seem to be attractive for new product activity (and innovation supports higher prices)