A focus on small brands

Challenges and opportunities for the majority of brands (because only so many brands can be large)

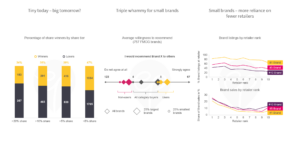

Tiny today – big tomorrow?

Where do we find more share growth: among big or small brands? For 5000 top ten brands across many countries and categories we compared share trajectories over five years based on the share tier they started with.

The findings are noteworthy:

(1) The percentage of winning brands (i.e. brands gaining share) is highest amongst brands starting out with less than 5% market share and lowest amongst brands that already command a high share.

(2) Among winning brands, however, the average increase of 4.7 percentage points inmarket share for the big brands easily outperforms the average increase of 1.5 percentage points for small brands (note that big brands need less additional penetration to gain an additional share point). Not surprising, the average share losses for losing brands are larger for bigger brands as well.

(3) At an aggregate level, the small brand tier gains more. Together all winning brands in the smallest share tier added 2,347 percentage points in market share, whereas their big, but much less numerous counterparts could only reap a total of 862 percentage points.

Triple whammy for small brands

Double jeopardy is well documented: Compared to larger brands, smaller brands have fewer buyers that buy them slightly less often.

However, these small brands have to overcome a third obstacle in their growth quest: An analysis of consumer attitudes for some 750 FMCG brands in nine European markets reveals that they receive consistently lower brand perception ratings than large brands (this gap is larger for “subjective” perceptions like willingness to recommend or perceived quality than for “objective” perceptions like advertising intensity or new product activity). This is not surprising, and has been well documented in many research studies: Users of a brand are much more likely to have positive attitudes than non-users. However, even their own users rate these small brands consistently lower than users of large brands do. To make matters worse, non-users of small brands are also less enthusiastic about these small brands than non-users of large brands. A case of quadruple jeopardy?

Small brands – more reliance on fewer retailers

Big brands are attractive for most retailers because they are able to increase shelf turnover and enjoy high equity. Big retailers are attractive for most brands because they give them more exposure and reach more potential shoppers. However, not all retailers will feature all major brands in a category: After all, shelf space is limited, private labels need the same real estate and more brands add more complexity to an assortment. We examined the availability of top ten brands across more than 60 categories in the top ten retailers in 9 countries.

Not surprisingly, larger retailers are more likely to list brands of any rank. For example, the average number 1 brand is listed in nearly 90% of the top three retailers whereas its availability drops to below 80% in smaller retailers.

Top retailers add lower ranked brands to their assortment more often than smaller retailers do. Shoppers find the average number 6-10 brand in about half of all top three retailers, while their availability drops below 40% for smaller retailers.

As a consequence, smaller brands depend more on each retailer where they are available. One could argue that in addition to shopper-based double jeopardy (fewer buyers buying them more often), they also face double jeopardy vis-à-vis retailers: They are listed by fewer retailers than bigger brands, and are more reliant on each.