Growth of brands in Europe from 2019-2023

More learnings from 16 countries

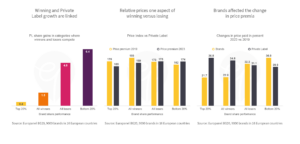

Winning and Private Label growth are linked

Given the massive gains Private Labels in Europe experienced over the past five years (more than 3% share gain in the average category) it is not surprising that brand share gains are more likely in categories where Private Label success is relatively modest. Is this caused by winning brands doing a relatively better job – or are they lucky to play in categories where Private Labels disappoint? Get in touch if you want to shine a spotlight on your brands and categories.

Relative prices one aspect of winning versus losing

The average brand sells at a premium of about 70% versus the average Private Label in the category. Winning brands saw their price premia decline over the past five years (by about 20%) while losing brands maintained their price premia. While these averages hide a lot of winners that were able to maintain or even increase their price premia, they highlight the importance of price in times of crises.

Brands affected the change in price premia

Over these five years FMCG prices went up more than anytime over the past few decades. Prices for Private Labels increased by about 30% with slightly higher increases in categories where brands were winning. However, the average winning brand increased its price substantially less (around 20%) than the average losing brand (more than 30%). Make sure you can justify your price levels by continuously building the equity of your brands.