Cyclical innovation by brands

In our latest blogs we examined how category innovation developed during the early COVID-19 pandemic. Overall, we saw category innovation declining. This blog examines how active individual national brands (NBs) were in launching new products during the start of the pandemic crisis in 2020.

In our latest blogs we examined how category innovation developed during the early COVID-19 pandemic. Overall, we saw category innovation declining. This blog examines how active individual national brands (NBs) were in launching new products during the start of the pandemic crisis in 2020.

We compared new product launch activity of 13,040 NBs in 2018 and 2020 covering 8 countries across about 90 categories. This is what we find:

- In 2020, 22.6% of all NBs launched at least one new product, while 77.4% did not show any innovation activity at all. This level is almost the same as in 2018 when 23.3% of all brands launched.

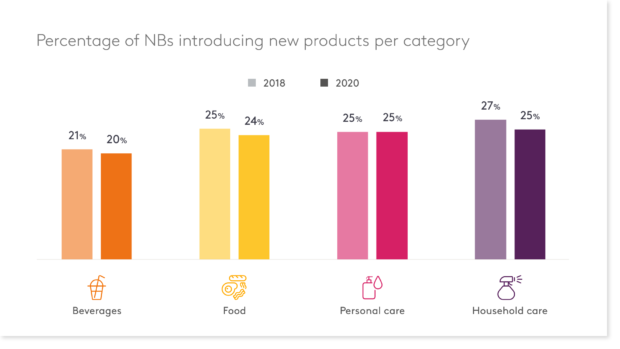

- This pattern is similar across categories (see below): While the number of NBs introducing new products is unchanged for personal care, we see small declines in launch levels in food and slightly higher reductions for beverages and household care.

- A more nuanced picture regarding the actual number of launches: Of all NBs, 13% introduced more new products compared to 2018 (more than half of these brands did not launch at all in 2018) while 2.5% maintained their innovation levels. 16% reduced the number of new products with about half of the latter group not launching at all in 2020.

- Brands without any launches represent the majority (69% launched neither in 2018 and 2020). This differs for category groups, for example, in household care this number is lower (65% of all NBs did not innovate in either year) and in food it is higher (71%).

Crises like the COVID-19 pandemic seem to reduce NB innovation activities indicating a cyclical innovation behavior. Blog #1 shows this is a bad idea: Investing in innovation in hard times will pay-off as these national brands will benefit from new products once times improve.

Countries included: Austria, Belgium, Hungary, Italy, Netherlands, Poland, Romania, Spain, Data on NBs Launch Activities between 2018 and 2020.