More brands – higher share

Most manufacturers compete with just one brand in a category, but 1 in 3 sell multiple brands. Offering a portfolio can stem from several considerations: (1) a belief that certain shopper expectations can be reached more effectively with a different brand, (2) better addressing shoppers’ need for variety or (3) worries about diluting the existing brand(s) if a different competitive position is desired. Either way, the common goal of launching more than one brand is to increase sales.

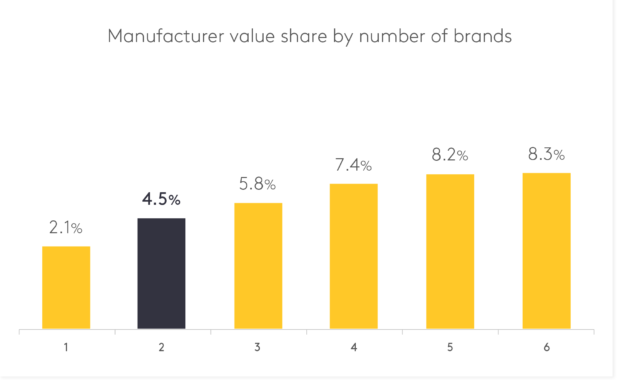

Based on the analysis of more than 10,000 manufacturer brand portfolios we find that larger portfolios indeed outperform smaller ones:

- The average two-brand portfolio attains more than twice the

share that the average one-brand manufacturer reaches.

share that the average one-brand manufacturer reaches. - The incremental share from selling more brands declines from the third brand onwards, with the average five brand portfolio reaching just under four times the share of an average one-brand manufacturer.

- However, more brands (beyond the 2nd brand) pay off disproportionately in high frequency categories where a five-brand portfolio on average commands a 5.5 times higher share than what the average one-brand manufacturer can expect.

- While the relative contribution of more brands becomes more pronounced with higher category frequency, the actual share of a five-brand portfolio in high frequency categories is lower (6% in high frequency vs 10% in low frequency categories) as these categories feature stronger competition.

Larger portfolios in terms of number of brands indeed are able to capture higher shares. This is less pronounced in low frequency categories and more so in high frequency categories although the actual share and share gain from each brand is lower in high frequency categories due to competitive effects.

Data:16,000 national brand manufacturers per year, top 30 manufacturers per country (incl. PLs), 10 countries, 6 years of data, up to 90 consistently defined categories