To start the New Year we look at how Discounters and Private Labels are developing across Europe

And the reasons why – especially the levels of category inflation.

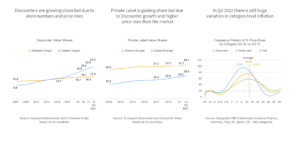

Discounters are growing share but due to store numbers and price rises.

Since 2019 there are now 5% more Discounter stores in Western Europe and 25% more in Eastern Europe. Add to this that their prices are rising 50% more than the market (14.2 vs 9.6%) and the reasons for share growth are obvious. The net result increases the importance of working with Discounters.

Private Label is gaining share but due to Discounter growth and higher price rises than the market.

PL prices are rising nearly 50% more than the total market (13.9 vs 9.6%). Discounters are increasing share due to store numbers and pricing. These two factors lie behind PL share growth. The net result underscores the need for continued investment in brands.

In Q3 2022 there is still huge variation in category level inflation.

Category inflation currently ranges from significant deflation to over 50% increases. This is also the case for Private Label and Discounters but their prices are rising much faster than the total market with more categories at the higher inflationary end.