Promotion-specific differences between frequent and infrequent categories and between large and small brands.

Small brands’ promo dependence is much higher than for large brands.

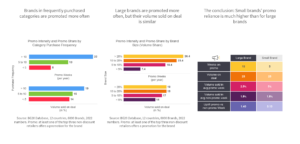

Brands in frequently purchased categories are promoted more often

The average brand in a frequently purchased category (more than ten times per year) is sold on promotion by at least one of the country’s Top 3 retailers 22 weeks per year. This is almost three times as often as the average brand in an infrequently purchased category (less than 5 times per year). The share sold on promotion between these brands differs less: 19% vs 14%.

Large brands are promoted more often, but their volume sold on deal is similar

The larger a brand the more often it is sold on promotion by at least one of the country’s Top 3 retailers. For example, the average large brand (>20% volume share) is promoted more than three times as often as the average small brand (<5% volume share): 26 weeks vs 7 weeks. However, the promoted percentage of sales differs little: 19% vs 14%.

The conclusion: Small brands’ promo reliance is much higher than for large brands

If large brands sell a similar percentage of their volume on promotion while being on promotion much more often, their reliance on promotions is smaller. Consider this hypothetical example: A large brand that is on promotion 10 out of 52 weeks (for simplicity let’s assume: in all outlets) and selling 25% of its volume during these weeks achieves about 1.8% of its yearly volume sales in a non-promoted week (and 2.5% in a promoted week). A small brand that is on promotion 5 weeks only and in these weeks also sells 25% of its volume attains about 1.6% of its yearly volume in a non-promoted week (but 5% in a promoted week). The conclusion: Larger brands enjoy much more salience at regular prices and rely less on discounting when it comes to driving choice at the POS.