Shopping Frequency among New, Lost and Retained Buyers

Retained Buyers of a Brand buy it about twice as often in a given year than new buyers in that year or lost buyers in the previous year

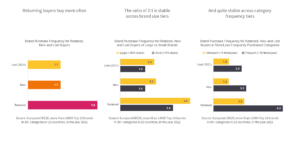

Returning buyers buy more often

We showed in last week’s pick that higher purchase frequency (of a brand or category) translates into higher reach because the odds of a purchase happening in any given time period increase. Not surprisingly, retained buyers (i.e. households that purchased the brand in the previous year) buy it more often than new buyers (i.e. households that did not purchase the brand in the previous year) or lost buyers (i.e. households stopping to buy this year) did in the previous year. More frequent buying reduces the odds of “missing a year”.

The ratio of 2:1 is stable across brand size tiers

The rule of thumb that retained buyers buy about twice as often as new or lost buyers holds for both small and large brands. If a shopper is choosing a specific brand frequently, it is less likely that they stop buying in any given year and qualify as a new or lost buyer. If a shopper is choosing a specific brand less frequently, the odds of not choosing this brand in a given year (and hence qualifying as new or lost) increase.

And quite stable across category frequency tiers

Not surprisingly, the average brand in frequently purchased categories is chosen more often irrespective of whether we look at new, lost or retained shoppers. The ratio between retained and both new and lost remains stable at about 2:1 for different category frequencies. We see a small uplift of “new” 2022 shoppers versus shoppers in 2021 that did not buy in 2022 (“lost”), which is a result of fewer visits in a year with more frequent lockdowns (2021).