How category purchase frequency impacts brands and not just launches

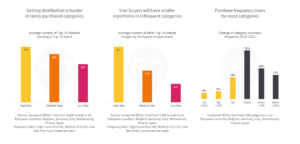

Getting distribution is harder in rarely purchased categories

Last week we showed that launches face more competition from other launches in frequently purchased categories – which results in less reach on average than launches in less frequently purchased categories achieve. However, category purchase frequency also affects brands, for example in their efforts to get listed. Retailers will stock more brands in frequently purchased categories (7.6 of the Top 10 retailers will carry the average Top 10 brand) than in less frequently purchased ones.

Your buyers will have smaller repertoires in infrequent categories

The more often a category is purchased the more often shoppers have an opportunity to switch to other alternatives. Hence it is no surprise that in more frequently purchased categories the average shopper has a larger repertoire of national brands in their choice set. While the average brand buyer in infrequent categories buys less than one additional national brand in a year, the average brand buyer in frequent categories buys more than two other national brands. In addition, smaller brands (outside the Top 10) and Private Labels will be part of many shoppers’ repertoires.

Purchase frequency down for most categories

Over the past five years we have seen category purchase frequency drop in a majority of categories. About one quarter of the 500 categories in our sample experienced an increase in shopping frequency while a majority saw shopping frequency decline. For the average category, shopping frequency dropped by 7%, from 7.66 occasions in 2019 to 7 occasions in 2023. Examples of categories where frequency increased are hard cheese, ice cream or crisps, while frequency dropped for margarine, nappies or coffee.